1. Deduction u/s 80-IA/80-ID/80-IE will be allowed only if the assessee furnishes the return of income u/s 139(1)

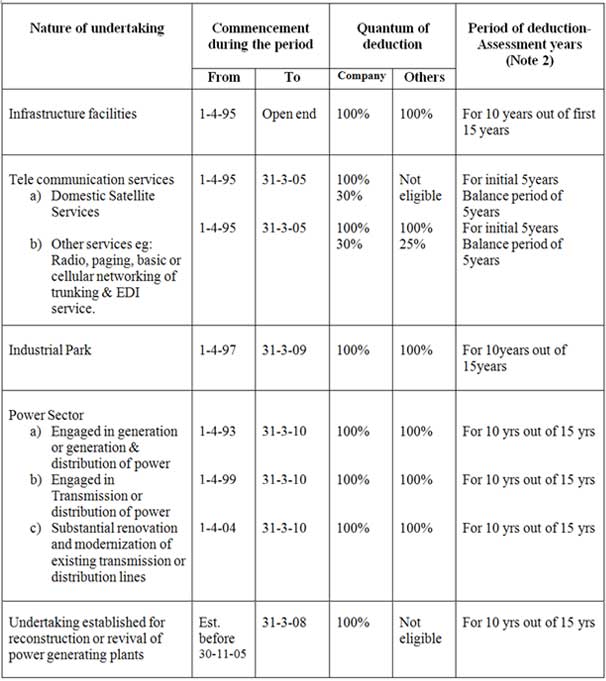

2. Period of deduction-Assessment years:

a) For any 10 consecutive years out of 15 years beginning from the year in which the undertaking or the enterprise-

- Develops and begins to operate any infrastructure facility, or

- Starts providing Telecommunication services, or

- Develops an Industrial park, or

- Generates power or commences transmission or distribution of power, or

- Undertakes substantial renovation and modernization of the existing transmission or distribution lines.

b) For operation and maintenance of the infrastructure facilities subject to fulfillment of conditions, the period of 15 years is substituted by 20 years.