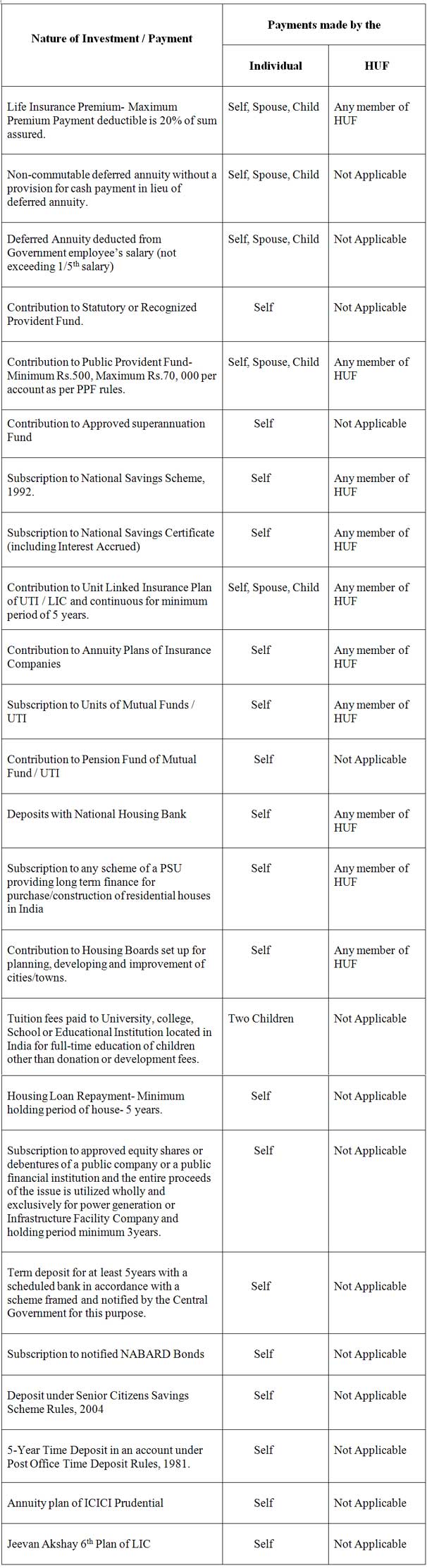

1. Applicability: Individual or HUF

2. Conditions:

- Investments or contribution should be made in approved investment schemes.

- The payment need not necessarily be made out of income chargeable to tax.

- Deduction shall be allowed only on payment basis not on accrual basis.

3. Maximum deduction: The maximum amount along with deduction u/s 80CCC and 80CCD or independently u/s 80C, restricted to Rs.1, 00,000

4. Eligible Investments:

Conditions to be satisfied in respect of contributions qualifying for deduction u/s 80C

- LIC premium on life or Endowment policies:

- The policy should not be surrendered within 2years incase of single premium policy or before payment of premium for 2years in case of other policies.

- Non-compliance with the above will entail considering deduction so claimed as income of the previous year in which deduction was so claimed.

- Repayment of Housing loan:

- House constructed or purchased out of loan must be for residential purposes.

- The assessee should not transfer the house for 5years.

- If the assessee transfers his property within 5years of construction / acquisition, then-

- No deduction shall be allowed in respect of repayments made during the year of termination ,

- The aggregate of deductions availed earlier in respect of such repayment of installments shall be deemed to be income of assessee in the year of transfer of property.

- Unit Linked Insurance Plan:

- Participation period: The assessee member should not terminate his participation in the ULIP scheme before making contribution for 5years.

- Termination within 5years: If the assessee has terminated within 5 years of contribution, then the following shall apply-

- No deduction shall be allowed in respect of contributions made during the year of termination,

- The aggregate of deductions availed earlier in respect of such plan shall be deemed to be income of assessee in the year of transfer of property.

- Tax treatment on withdrawals from senior citizen savings scheme and 5 year term deposits:

- Impact on withdrawal: If any amount including accrued interest is withdrawn by the assessee from his account before the expiry of 5years from the date of its deposit, the amount so withdrawn shall be deemed to be the income of the assessee in the year of withdrawal and shall be liable to tax in the relevant previous year.

- Exception:

Any amount of interest, relating to deposits which has been included in the total income of the assessee of the previous year or in preceding previous years, and

Any amount received by the nominee or legal heir of the assessee, on the death of the assessee except interest accrued, which was not included in the total income of the assessee for the previous year or in the preceding previous years.