Loss or expenditure already allowed in computation of income from other sources and subsequently recovered shall be treated as the income of the previous year in which it is recovered.

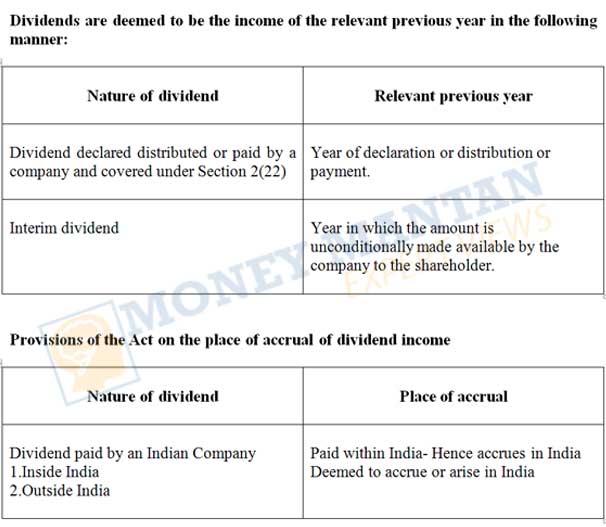

Deemed Dividend (Sec. 2(22)):

- Dividend for the purpose of Income Tax is a wider term than what is understood in common parlance. The Act provides an inclusive definition of Dividend in section 2(22), and covers the following distributions and payments-

- Distribution of accumulated profits, whether capitalized or not, when such distribution by the company to its shareholders, entails the release of all or any part of the company’s assets.

- Distribution of debentures, debenture-stock or deposit certificates in any form, with or without interest and distribution of bonus shares to preference shareholders, to the extent the company possess accumulated profits, whether capitalized or not.

- Distribution on liquidation, to the extent such distribution is attributable to the accumulated profits of the company immediately after its liquidation, whether capitalized or not.

- Distribution on reduction of capital, to the extent the company possesses accumulated profits are capitalized or not.

- Payment of any sum by a company in which the public are not substantially interested, by way of Advance or Loan, to the extent the company possesses accumulated profits, to-

- A Shareholder, who is beneficial owner of shares carrying not less than 10% voting power.

- Any concern in which such shareholder is a member or partner, having beneficial entitlement to not less than 20% of such concern’s income.

- Any payment on behalf, or for the individual benefit, of such shareholder.

2. Meaning of Accumulated Profits:

- General: All profits up to the date of liquidation

- Special: If liquidation is consequent to compulsory acquisition Govt. or Govt. Corporation, profits up to date of liquidation, except profits of three successive previous years immediately preceding the year of liquidation.

Exceptions: Dividend does not include-

- Distribution covered by (c) and (d) above, in respect of shares issued for full cash consideration, where the shareholder is not entitled to participate in the surplus assets upon liquidation.

- Advance or loan to a shareholder or concern, by a company carrying on lending business, in the ordinary course of is business.

- Dividend paid by a company, which is set-off wholly, or in part against previous payments made and deemed as dividend by (e) above; to the extent it is so set-off.

- Payment made on purchases of its own shares as per Sec.77A of the companies Act, 1956

- Distribution of shares pursuant of a de-merger by the resulting company, to the shareholders of the de-merged company, whether or not, there is a reduction of capital in the de-merged company.