- Assessment Year for which this Return Form is applicable This Return Form is applicable for assessment year 2011-2012 only, i.e., it relates to income earned in Financial Year 2010-11.

- Who can use this Return Form This Return Form is to be used by an individual or a Hindu Undivided Family whose total income for the assessment year 2011-12 includes:-

- Income from Salary / Pension; or

- Income from House Property; or

- Income from Capital Gains; or

- Income from Other Sources (including Winning from Lottery and Income from Race Horses)..Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used where such income falls in any of the above categories.

- Who cannot use this Return Form This Return Form should not be used by an individual whose total income for the assessment year 2011-12 includes Income from Business or Profession.

- Annexure-less Return Form

- No document (including TDS certificate) should be attached to this Return Form. All such documents enclosed with this Return Form will be detached and returned to the person filing the return.

- Tax-payers are advised to match the taxes deducted/collected/paid by or on behalf of them with their Tax Credit Statement (Form 26AS). (Please refer to www.incometaxindia.gov.in)

- Manner of filing this Return FormThis Return Form can be filed with the Income Tax Department in any of the following ways, –

- by furnishing the return in a paper form;

- by furnishing the return electronically under digital signature;

- by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V;

- by furnishing a Bar-coded return.

- Where the Return Form is furnished in the manner mentioned at 5(iii), the assessee should print out two copies of Form ITR-V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bangaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.

- Filling out the acknowledgement

- Only one copy of this Return Form is required to be filed. Where the Return Form is furnished in the manner mentioned at 5(i) or at 5(iv), the acknowledgement slip attached with this Return Form should be duly filled.

- Codes for filling this Return Form Under the heading ‘Filing Status’ in the Return Form details have to be filled regarding section under which the return is being filed by ticking in the relevant box provided therein.

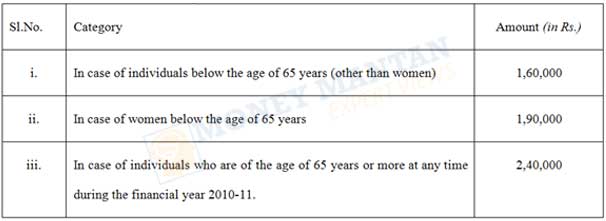

- Obligation to file return Every individual whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his return of income. The deductions under Chapter VI-A are mentioned in item 5 (“Income and Deductions”) of this Return Form. The maximum amount not chargeable to income tax in case of different categories of individuals is as follows:-

9. Codes for filling out this Form

- Some of the details in this form have to be filled out on the basis of the relevant codes.

- These codes have been provided below against the sections provided therein.

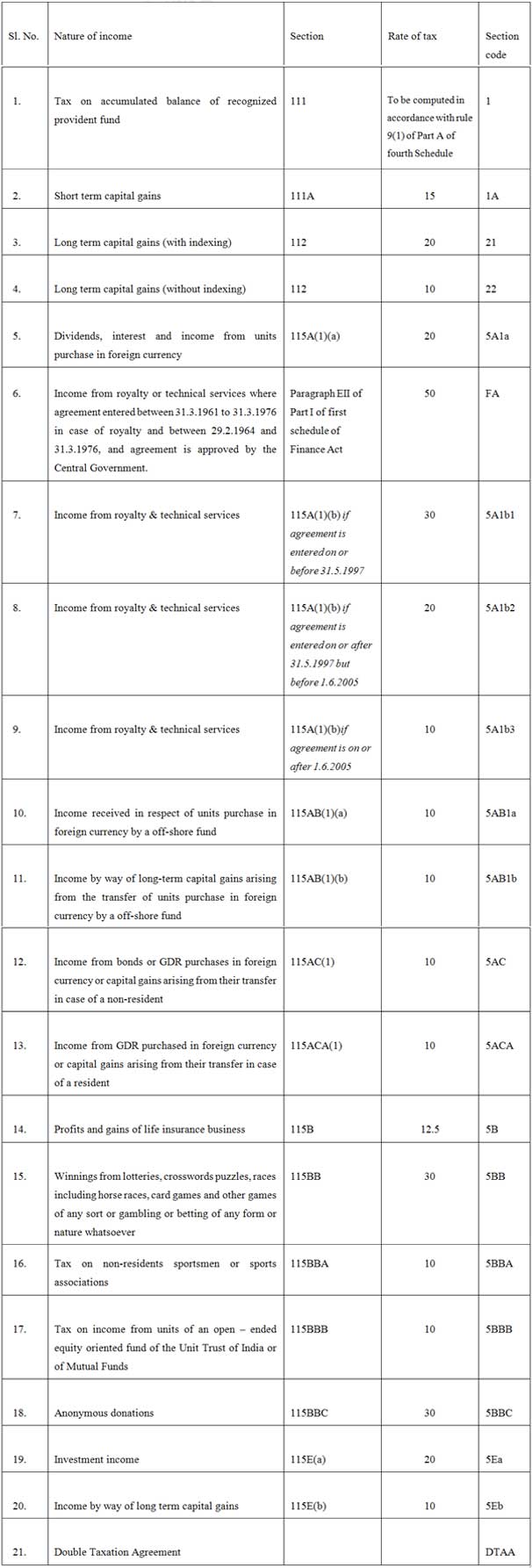

- In Schedule SI, the codes for the sections which prescribed special rates of tax for the income mentioned therein are as under:-

10. Scheme of the Law- Before filling out the form, you are advised to read the following-

(1) Computation of total income

(a) “Previous year” is the financial year (1st April to the following 31st March) during which the income in question has been earned. “Assessment Year” is the financial year immediately following the previous year.

(b) Total income is to be computed as follows, in the following order:

(i) Classify all items of income under the following heads of income-

(A) Salaries; (B) “Income from house property” ; (C) “Capital gains”; and (D) “Income from other sources”. (There may be no income under one or more of these heads of income).

(ii) Compute taxable income of the current year (i.e., the previous year) under each head of income separatelyin the Schedules which have been structured so as to help you in making these computations as per provisions of the Income-tax Act. These statutory provisions decide what is to be included in your income, what you can claim as an expenditure or allowance and how much, and also what you cannot claim as an expenditure/allowance.

(iii) Set off current year’s headwise loss(es) against current year’s headwise income(s) as per procedures prescribed by the law. A separate Schedule is provided for such set-off.

(iv) Set off, as per procedures prescribedby the law, loss(es) and/or allowance(s) of earlier assessment year(s) brought forward. Also, compute loss(es) and/or allowance(s) that could be set off in future and is (are) to be carried forward as per procedures prescribed by the law. Separate Schedules are provided for this.

(v) Aggregate the headwise end-results as available after (iv) above; this will give you “gross total income”.

(vi) From gross total income, subtract, as per procedures prescribedby the law, “deductions” mentioned in Chapter VIA of the Income-tax Act. The result will be the total income. Besides, calculate agricultural income for rate purposes.

(2) Computation of income-tax, education cess including secondary and higher education cess and interest in respect of income chargeable to tax

(a) Compute income-tax payable on the total income. Special rates of tax are applicable to some specified items. Include agricultural income, as prescribed, for rate purposes, in the tax computation procedure..

(b) Add Education cess including secondary and higher education cess as prescribed on the tax payable plus surcharge.

(c) Claim relief(s) as prescribed by the law, on account of arrears or advances of salary received during the year or of double taxation and calculate balance tax payable.

(d) Add interest payable as prescribed by the law to reach total tax and interest payable.

(e) Deduct the amount of prepaid taxes, if any, like “tax deducted at source”, “advance-tax” and “self-assessment-tax”. The result will be the tax payable (or refundable).

(3) Obligation to file return

(a) Every individual and HUF has to furnish the return of his income if his total income before allowing deduction under Chapter VI-A (i.e., if his gross total income referred to in item 9 of Part B-TI of this Form) exceeds the maximum amount which is not chargeable to income tax [Rs. 1,60,000/- in case of individuals below the age of 65 years (other than women) and HUF, Rs. 1,90,000/- in case of women below the age of 65 years, and Rs. 2,40,000/- in case of individuals who are of the age of 65 years or more at any time during the financial year 2010-11] .

(b) The losses, if any, (item-14 of Part B-TI of this Form) shall not be allowed to be carried forward unless the return has been filed on or before the due date.

11. SCHEME OF THE FORM

The Scheme of this form follows the scheme of the law as outlined above in its basic form. The Form has been divided into two parts. It also has fourteen work tables (referred to as “schedules”). The parts and the schedules are described below:-

- The first part, i.e., Part-A is spread over half of the first page of the return. It mainly seeks general information requiring identificatory and other data.

- The second part, i.e, Part-B on page 1 and page 2 is regarding an outline of the total income and tax computation in respect of income chargeable to tax.

- on page 2, there is a space for furnishing details of the transmission of the data of the form if the form has been furnished in the manner mentioned at instruction No.5(iii).

- After Part-B, on page 2, there is a space for a statutory verification.,

- On top of page 3, there are details to be filled if the return has been prepared by a Tax Return Preparer.

- On pages 3 to 6, there are 14 Schedules details of which are as under-

- Schedule-S: Computation of income under the head Salaries.

- Schedule-HP: Computation of income under the head Income from House Property

- Schedule-CG:. Computation of income under the head Capital gains.

- Schedule-OS: Computation of income under the head Income from other sources.

- Schedule-CYLA: Statement of income after set off of current year’s losses

- Schedule-BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier years.

- Schedule- CFL: Statement of losses to be carried forward to future years.

- Schedule-VIA: Statement of deductions (from total income) under Chapter VIA.

- Schedule SPI: Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of assessee in Schedules-HP, CG and OS.

- Schedule-SI: Statement of income which is chargeable to tax at special rates

- Schedule-EI: Statement of Income not included in total income (exempt incomes)

- Schedule-IT: Statement of payment of advance-tax and tax on self-assessment.

- Schedule-TDS1: Statement of tax deducted at source on salary.

- Schedule-TDS2: Statement of tax deducted at source on income other than salary.

12.GUIDANCE FOR FILLING OUT PARTS AND SCHEDULES

1) General

- All items must be filled in the manner indicated therein; otherwise the return maybe liable to be held defective or even invalid.

- If any schedule is not applicable score across as “—NA—“.

- If any item is inapplicable, write “NA” against that item.

- Write “Nil” to denote nil figures.

- Except as provided in the form, for a negative figure/ figure of loss, write “-” before such figure.

- All figures should be rounded off to the nearest one rupee. However, the figures for total income/ loss and tax payable be finally rounded off to the nearest multiple of ten rupees.

2. Sequence for filling out parts and schedules

- You are advised to follow the following sequence while filling out the form;

- Part A- General on page 1.

- Schedules

- Part B-TI and Part B-TTI

- Verification

- Details relating to TRP and counter signature of TRP if return is prepared by him.

13. Part-GEN

Most of the details to be filled out in Part-Gen of this form are self-explanatory. However, some of the details mentioned below are to be filled out as explained hereunder:-

- e-mail address and phone number are optional;

- In case of an individual, for “employer category”, Government category will include Central Government/ State Governments employees. PSU category will include public sector companies of Central Government and State Government;

- The code for sections under which the return is filed be filled as per code given in instruction No.7.

- In case the return is being filed by you in a representative capacity, please ensure to quote your PAN in item “PAN of the representative assessee”. In case the PAN of the person being represented is not known or he has not got a PAN in India, the item for PAN in the first line of the return may be left blank. It may please be noted that in the first line of this form, the name of the person being represented be filled.

14. Schedules

Schedule-S– In case there were more than one employer during the year, please give the details of the last employer. Further, in case, there were more than one employer simultaneously during the year, please furnish the details of the employer you have got more salary. Fill the details of salary as given in TDS certificate(s) (Form 16) issued by the employer(s). However, if the income has not been computed correctly in Form No. 16, please make the correct computation and fill the same in this item. Further, in case there was more than one employer during the year, please furnish in this item the details in respect of total salaries from various employers. In the case of salaried employees, perquisites have to be valued by the employee in accordance with the notification No. SO.3245(E) dated 18.12.2009, for the purposes of including the same in their salary income.

Schedule-HP,- In case, a single house property is owned by the assessee which is self-occupied and interest paid on the loan taken for the house property is to be claimed as a deduction. This schedule needs to be filled up. If there are two or more than two house properties, the details of remaining properties may be filled in a separate sheet in the format of this Schedule and attach this sheet with this return. The results of all the properties have to be filled in last row of this Schedule. Following points also need to be clarified,-

- Annual letable value means the amount for which the house property may reasonably be expected to let from year to year, on a notional basis: Deduction for taxes paid to local authority shall be available only if the property is in the occupation of a tenant, and such taxes are borne by the assessee and not by the tenant and have actually been paid during the year.

- Deduction is available for unrealized rent in the case of a let-out property. If such a deduction has been taken in an earlier assessment year, and such unrealized rent is actually received in the assessment year in question, the unrealized rent so received is to be shown in item 3a of this Schedule.

- Item 3b of this Schedule relates to enhancement of rent with retrospective effect. Here mention back years’ extra rent received thereon, and claim deduction @ 30% of such arrear rent received.

Schedule-CG,-

If more than one short-term capital asset has been transferred, make the combined computation for all the assets. Similarly, make the combined computation for all the assets if more than one long-term capital asset has been transferred.

(ii) For computing long-term capital gain, cost of acquisition and cost of improvement may be indexed, if required, on the basis of following cost inflation index notified by the Central Government for this purpose.

1 Comment

Dear Sir, I have purchased shares (of NSE listed companies) worth Rs. 1258962/- during F.Y 2012-13 and sold it for a value of Rs. 1536987/- in the same F.Y.(STT paid). A total amount of Rs. 21,865/- has been expended towards DP, internet, computer accessories, etc. in this regard. My STCG is thus Rs. 256160/- (278025-21865). When I substitute these values in CG of ITR-2 and try to validate the sheet, a message “Total quarterly break up in STCG other than 111A is less by 256160. Please rectify” is coming and could not generate the xml file. Kindly help me in this regard.

Comments are closed.