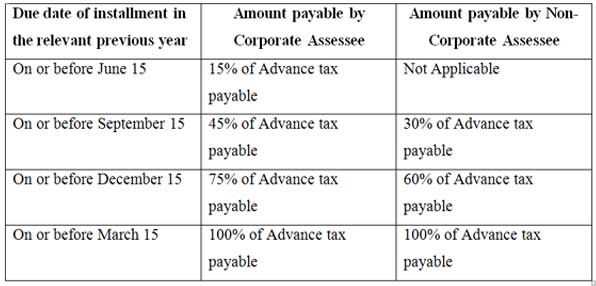

Advance Tax

All items of income (including capital gains, winning from lotteries, crossword puzzles, etc.,) are liable for payment of advance tax.

- Who is liable to pay advance tax: when the advance tax payable by any person for the assessment year immediately following the financial year is Rs.10,000/- or more

- An assessee who has opted for the scheme of computing business income under section 44AD on presumptive basis at the rate of 8% of turnover, shall be exempted from payment of advance tax related to such business with effect from the assessment year 2011-12 (in other words, in such a case advance tax will not be paid during the financial year 2010-11)

Note:

- Any amount paid by way of advance tax on or before 31st March of the relevant previous year shall also be treated as advance tax paid during the financial year ending on that day.

- If the due date of payment of advance tax is a banking holiday, the assessee can make the payment on the next immediately following working day. In such cases, no interest shall be leviable u/s 234B or 234C