Capital Gain – Computation

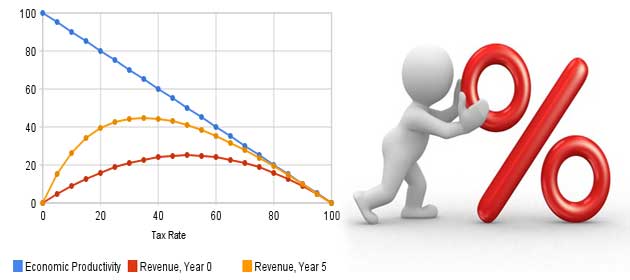

Computation of Short Term Capital Gain:Note: Securities Transaction Tax paid will not be allowed as deduction in computing Capital Gain. Indexation

Read More

Computation of Short Term Capital Gain:Note: Securities Transaction Tax paid will not be allowed as deduction in computing Capital Gain. Indexation

Read More

Short Term Capital Gain: a) Taxed at normal rates as applicable to various assesses. b) In respect of listed securities transferred on or after 1-10-2004 on which STT paid, section 111A will apply i.e. taxable at 15%. Tax on Short Term Capital Gain on Listed Securities-Section111A a) Applicability: All Assesses b) Source of income: Income […]

Read More