All

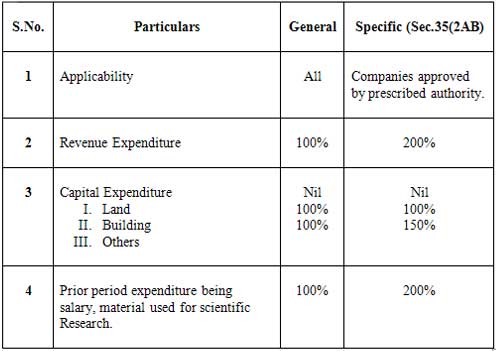

1. Expenditure on in-house research: The following expenditure incurred by the assessee on scientific research in relation to the assessee’s business shall be allowed as deduction-

- Current year expenditure: Current year revenue expenditure or Capital expenditure on scientific research.

- Prior period expenditure: Prior period revenue expenditure or capital expenditure incurred during 3years immediately preceding the date of commencement of business will be allowed as deduction in the previous year in which the assessee commenced the business.

- Expenditure on land: The expenditure on acquisition of land will not be allowed as a deduction.

- Depreciation: The assessee is not entitled to claim any depreciation on capital expenditure allowed as deduction.

2. Payment to Scientific Research Company: An amount equal to 125% of the sum paid to a company registered in India for the purposes of scientific research shall be allowed as a deduction if the following conditions are satisfied-

- The company should be approved by the prescribed authority.

- The main objects of the company should be Scientific Research and development.

3. Deduction for companies in special business:

- In case of a company engaged in the business of manufacture or production of the following items, an amount equal to two times (200%) of the expenditure incurred on Scientific research shall be allowed as deduction: Chemicals, drugs, pharmaceuticals, Bio-technology, Electronic equipments, Computer, Tele-communication equipments, Aircraft, Helicopter, Computer Software, Automobile& its components, Agricultural implements, Seeds.

- The cost of any land will not be allowed as a deduction.

- The cost of building is not entitled for weighted deduction, but eligible for 100% deduction.

- Condition: The company engaged in the specified business should enter into agreement with the prescribed authority for the purpose of- Cooperation in Research and development, Audit of accounts maintained.

4. Contribution for research:

- Purpose: The contribution may be either for Scientific Research or for social or statistical research.

- Recipient: Contribution may be made to any laboratory owned or financed by the Government or any notified university, college or institution or National laboratory or university or Indian Institute of Technology.

- Deduction: The amount of deduction is 175% of the amount paid by the assessee.

- Condition: The association, University, college etc, should be

- Approved in accordance with prescribed guidelines subject to such conditions as may be prescribed.

- Specified as such by a notification in the Official Gazette by the Central Government.

- Subsequent Withdrawal of approval: If the approval accorded to the university, college, etc. is withdrawn subsequent to the payment of such sum by the assessee, the deduction shall not be denied to the assessee.

a) No other deduction: Any amount allowed as deduction in this section will not qualify for deduction under any other provision of Income Tax Act.

b) Carry forward and set-off of unabsorbed capital expenditure: It shall be carried forward in the same manner as unabsorbed depreciation.

c) Consequences in the case of amalgamation:

- Situation: In pursuance of an agreement of amalgamation, amalgamating company transfers asset representing capital expenditure eligible for deduction u/s 35.

- Consequences: Section 35 would apply to the amalgamated company as they would have applied to the amalgamating company, as if the amalgamation had not taken place.

d) Allow ability of Scientific Research expenditure:

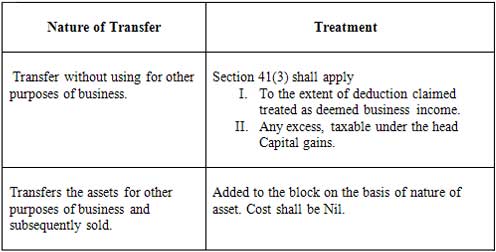

e) Treatment of transfer of assets used for Scientific Research: