- One property at the option of the assessee treated as self-occupied and income shall be computed as in the case self-occupied property kept vacant

- For all other properties self-occupied, income shall be calculated as deemed let out.

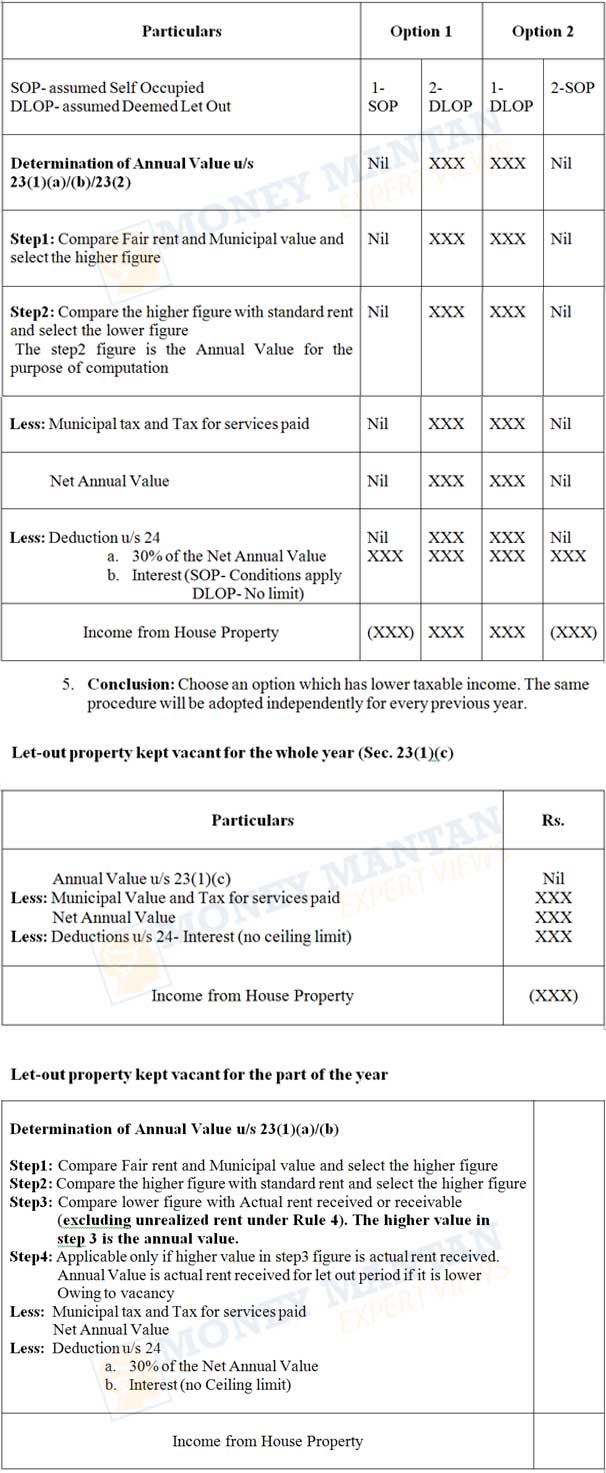

- The assessee can choose an option which will have lower taxable income that may be computed as follows:

- Illustrative presentation for 2 properties self-occupied:

December 23, 2024